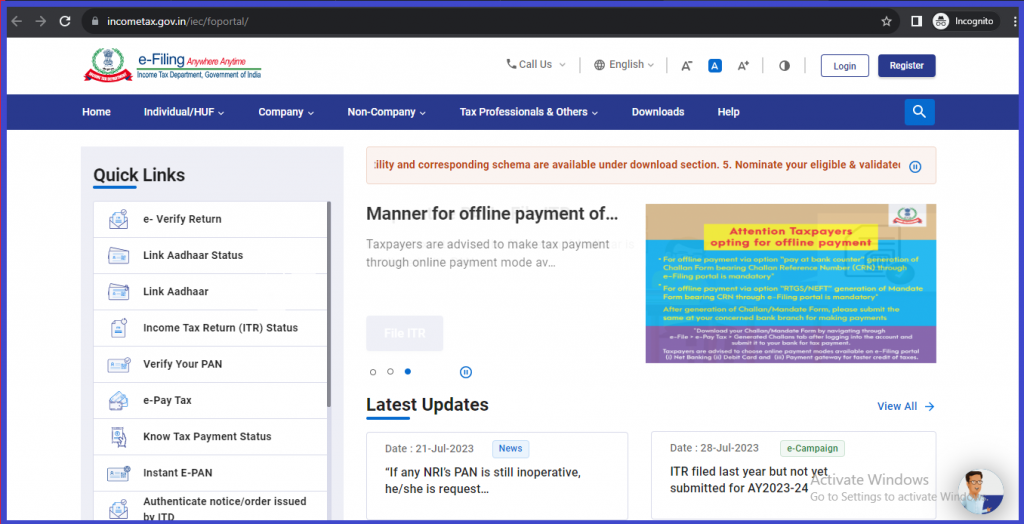

Step-1: Go to e filing portal i.e. incometax.gov.in

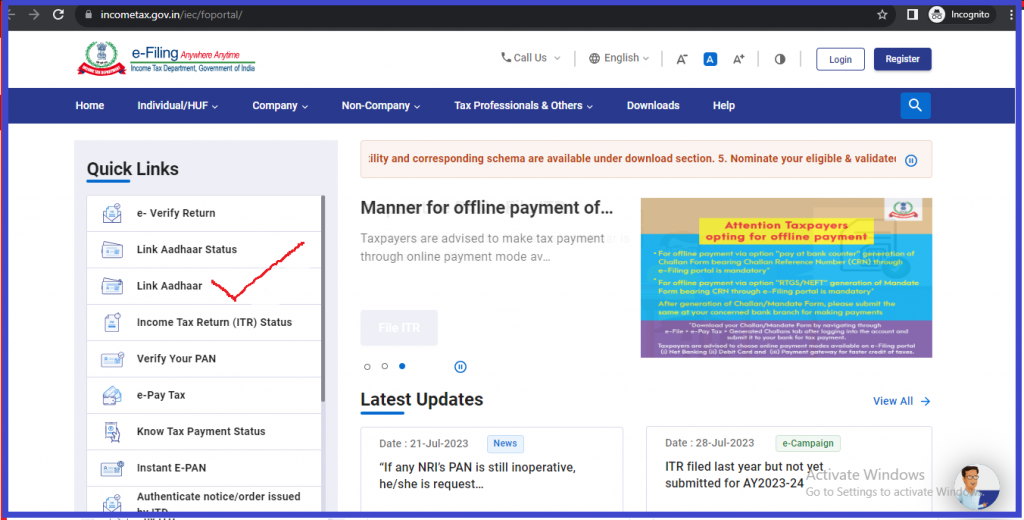

Step-2: Click on the left side “Link Aadhaar”

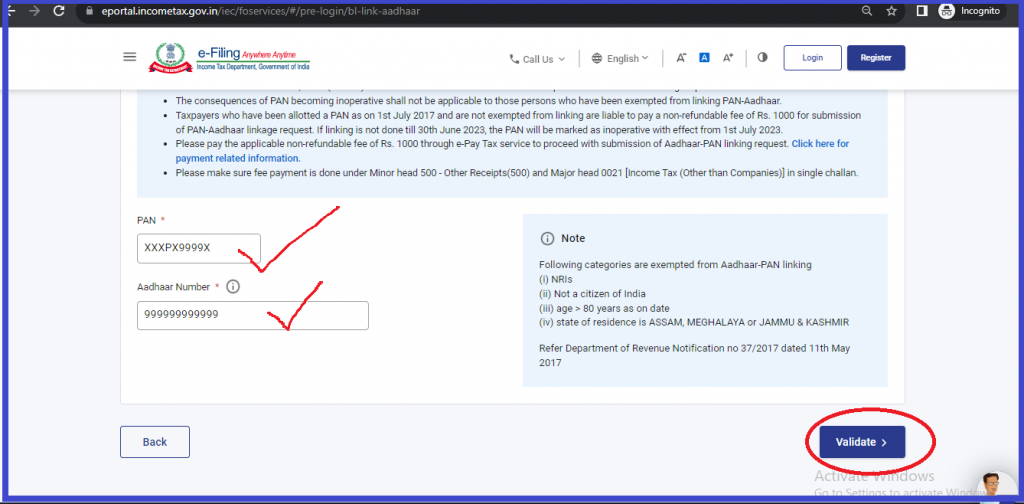

Step-3: Enter PAN number and Aadhaar number and click on validate.

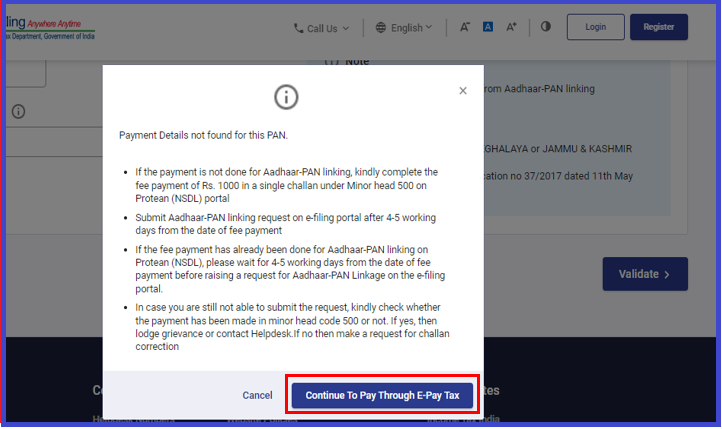

Step-4: Click on “Continue to Pay through E-Pay Tax”

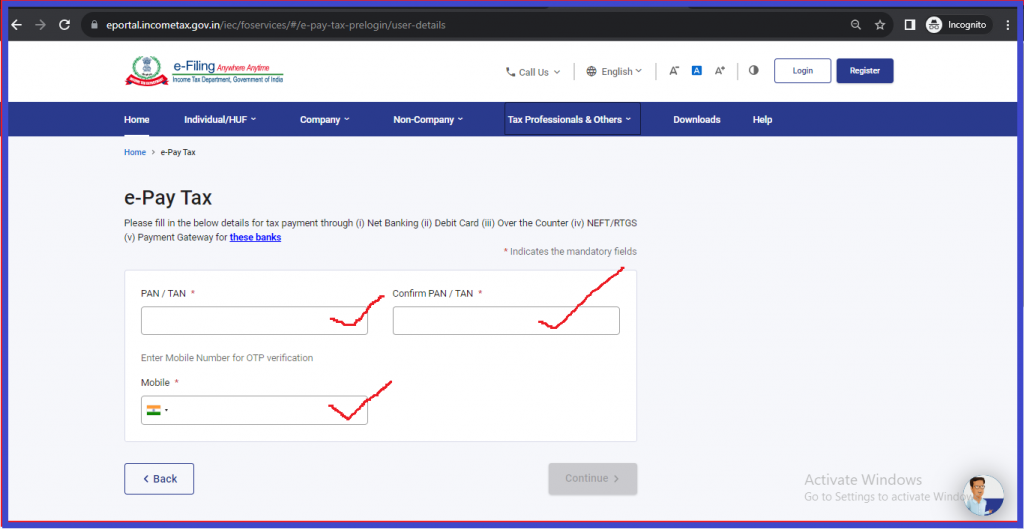

Step-5: Enter your PAN number and Mobile number then click on Continue.

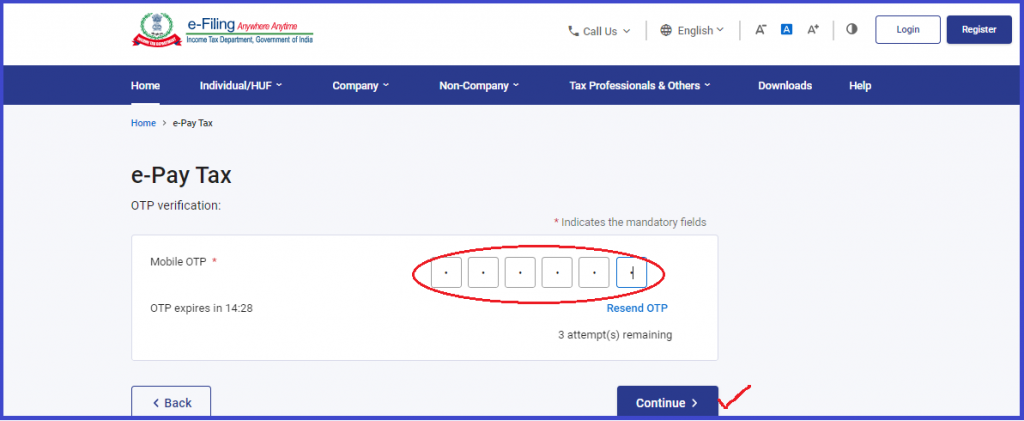

Step-6: Enter OTP then Click on continue

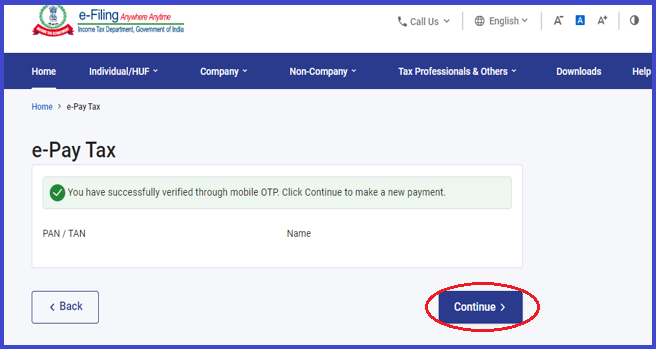

Step-7: Click Continue

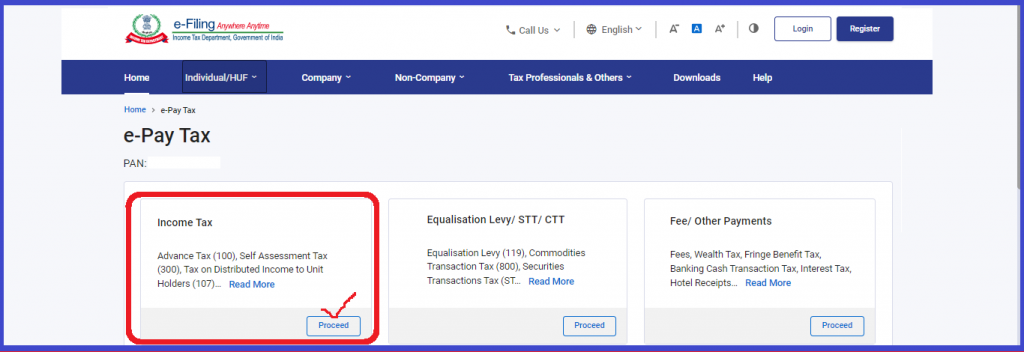

Step-8: Click on the proceed button of Income Tax Tab

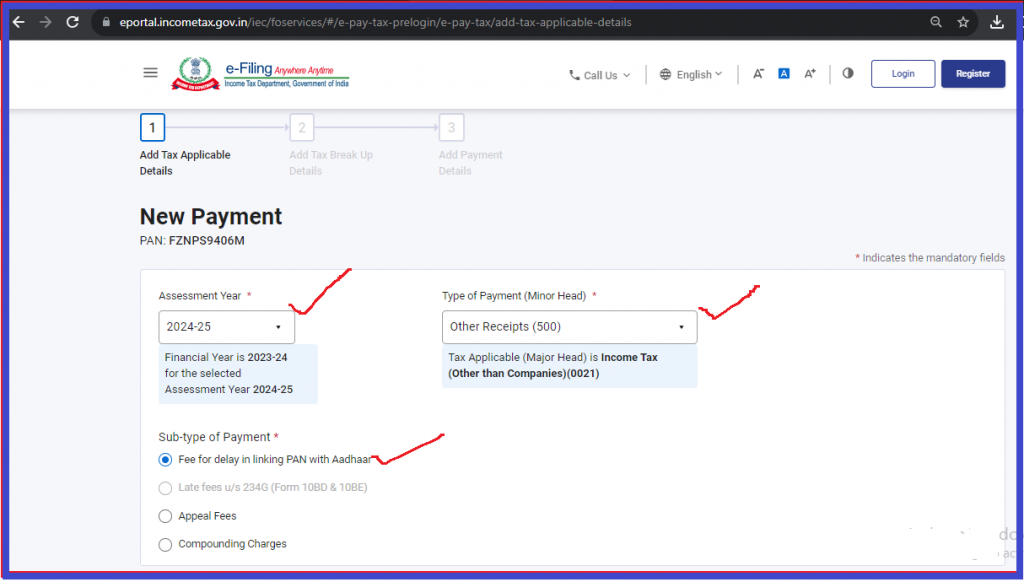

Step-9: Choose Assessment Year 2024-25, Type of Payment Other Receipts (500) and Fee for delay in linking PAN wit Aadhaar.

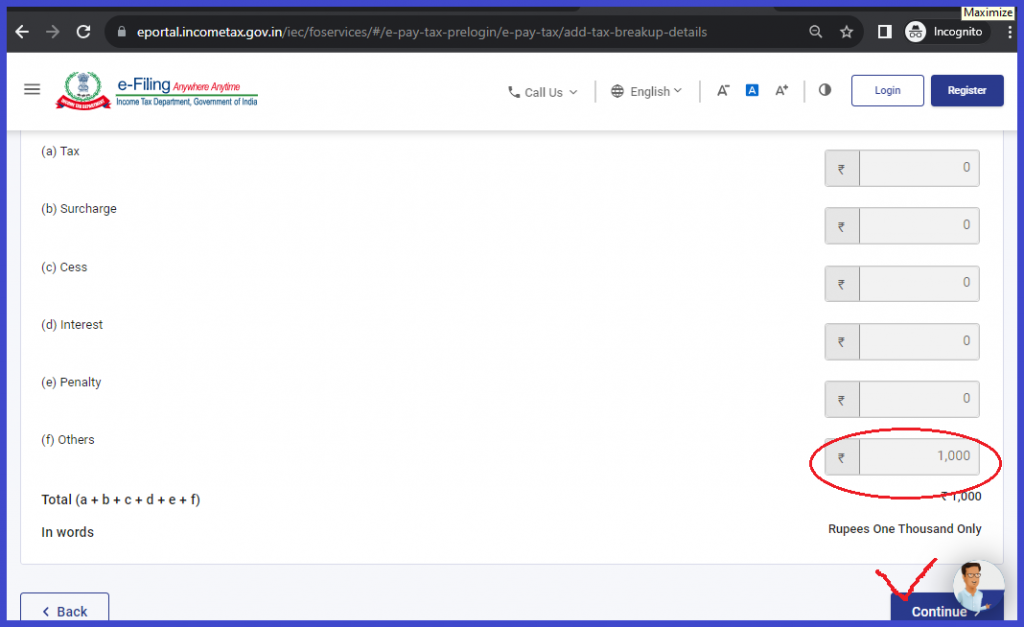

Step-10: Click Continue

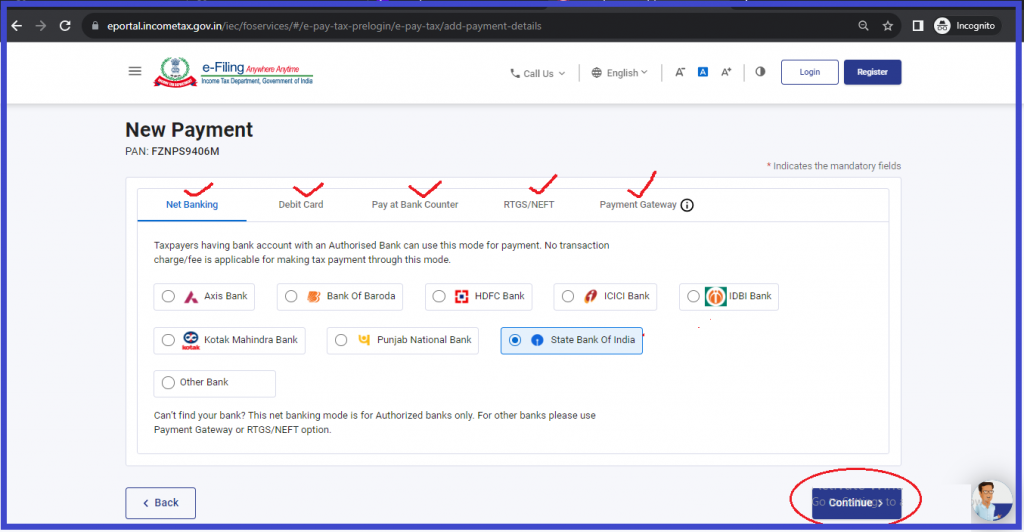

Step-11: Choose the option by which you want to pay the amount. If you want to pay by UPI choose Payment Gateway and continue.

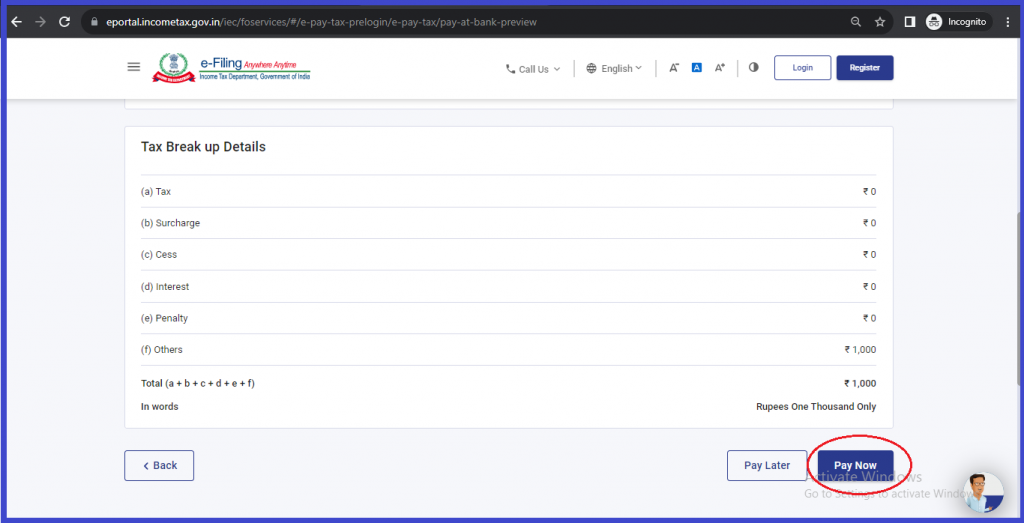

Step-12: Click Pay Now

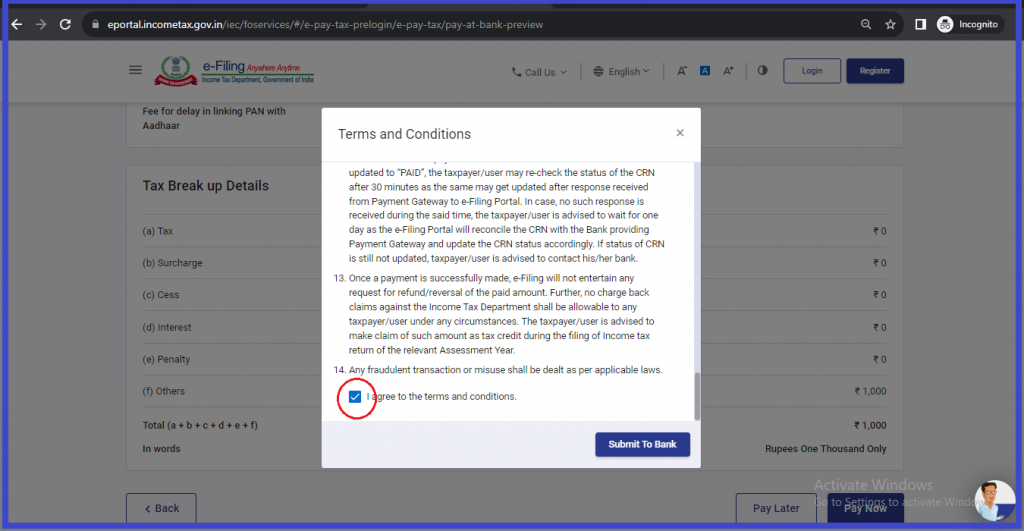

Step-13: Tick on “I agree ……” and then Submit to Bank and complete payment process.

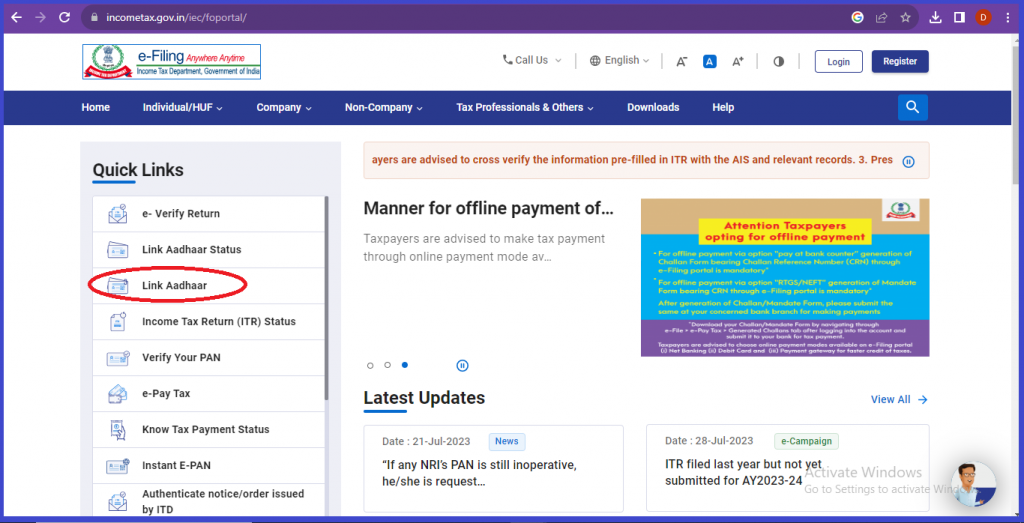

Step-14: After completing the payment, come on the HOME page of incometax.gov.in and click Link “Aadhaar”

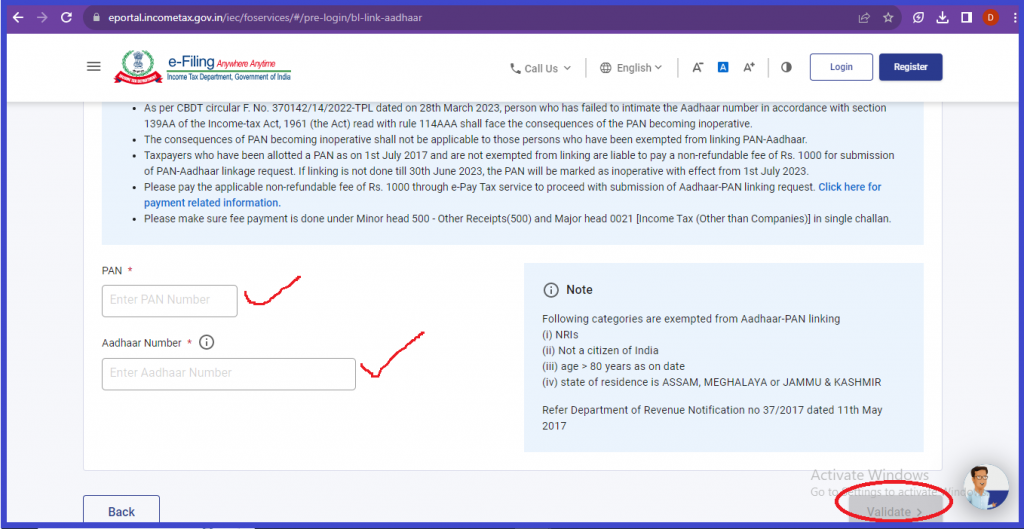

Step-15: Enter your PAN and Aadhaar number for which you made payment and click “validate”.

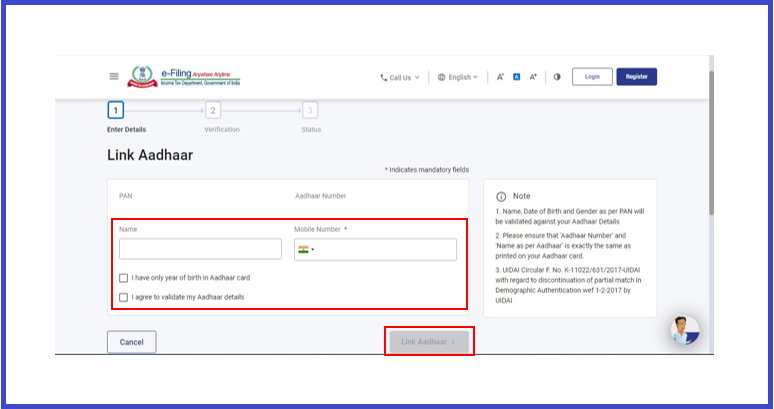

Step-16: Enter NAME and Mobile Number and tick on both statement and click on “Link Aadhaar”

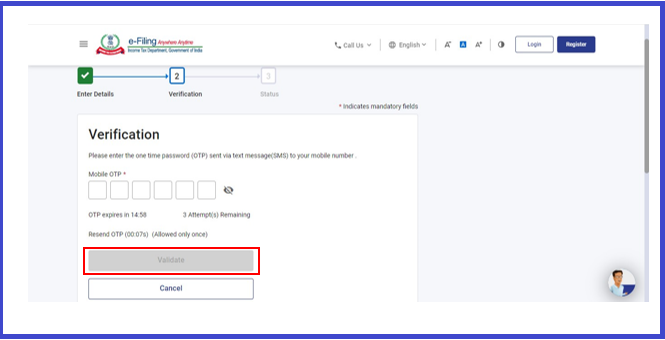

Step-17: Enter OTP and click “Validate”

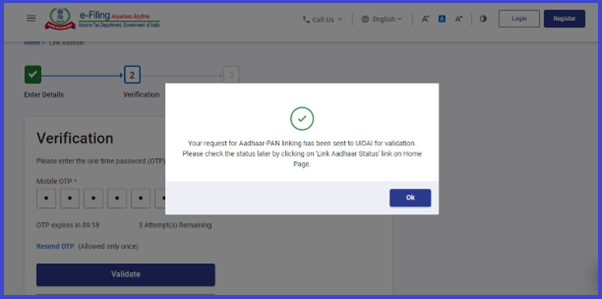

Step-18: This pop up will be shown on screen. After that much process you have to wait for around 3 to 4 working days.

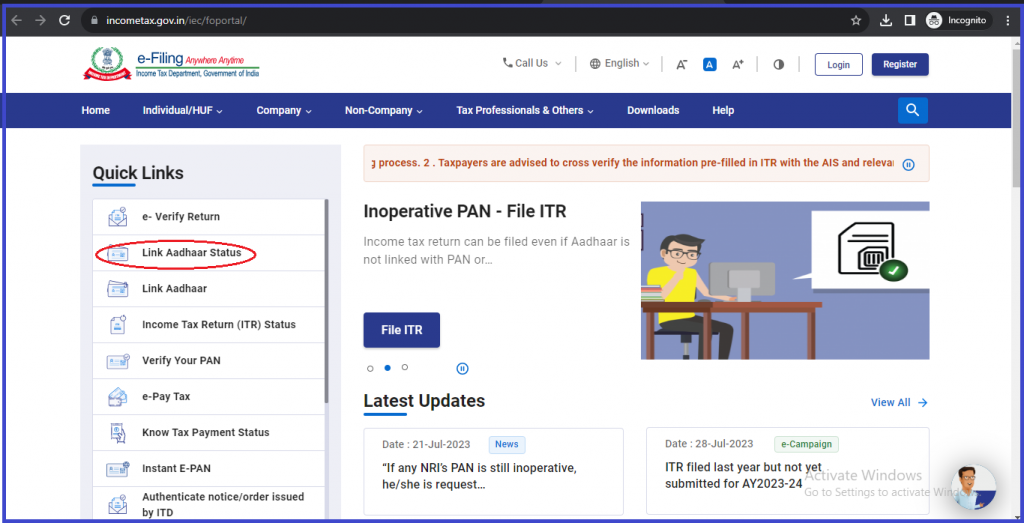

Step-19: After 3 to 4 working days come on home page of incometax.gov.in and click “Link Aadhaar Status”

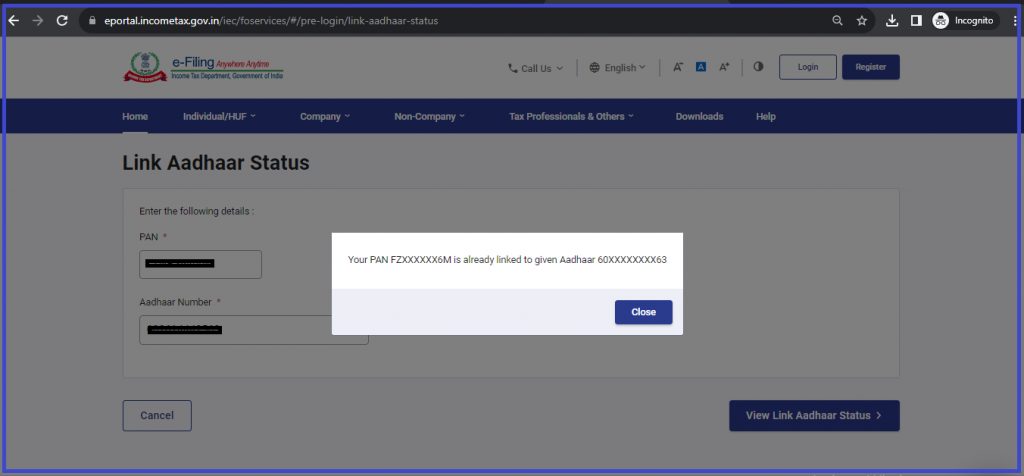

Step-20: After entering PAN and Aadhaar number and click “View Link Aadhaar Status” , this pop up will be shown on the screen and that means your pan is linked to your Aadhaar number.